The curious case of gondola.finance, Roger Lu of Hazelbrook Capital and Ava Labs.

The premise of Gondola Finance is simple, to provide swap pairs between wrapped assets within the avalanche ecosystem. This bridges liquidity, and solves the dilemma of swapping between otherwise fragmented “non-fungible” liquidity involving different versions of the same base asset (example swap enabled: WBTC to Ren-BTC).

Gondola has partnered with Zero exchange (which is currently transitioning to the Relay Chain), Ren, DCTDAO and has additional, still theoretical, cross chain functionality (but with no current liquidity) through a BSC integration. These factors are positive, in that progress and integration has been made by the development team.

Warning: the following is less positive.

Gondola incentivises liquidity provision within swap pair pools, through the token $GDL. The emission of GDL is according to the Gondola team’s tokenomics schedule. In short, half a billion GDL will be pumped out to the various liquidity providers, over a halving schedule for a few years; GDL is currently emitted and rewarded to LP’s of the base swap assets, autocompounders holding GDL, and autocompounding of GDL-ZERO. Other than being a reward token, GDL has no obvious function which brings it any value other than to be sold for profit. For the numbers: 500M token will be minted. 300M (60%) will be distributed through liquidity mining, 100M (20%) as ecosystem reserve, 50M (10%) as developer fund, 25M (5%) for airdrop and 25M (5%) for marketing (https://gondola-finance.github.io/doc/docs/getting-started/introduction/).

Roger Lu, also known as Roger DeFi twitter handle @rogerclu, is a self proclaimed advisor to “Ava Labs”, and Gondola Finance. He is also a digital venture capitalist, with Hazelbrook Capital. He has openly promoted gondola.finance on his Twitter feed, and openly stated he provided seed funding, with funds locked for 6 months with the Gondola developer fund. Fair enough.

Late last week, early July 2021, the revelation that GDL amounting to 2000 worth of AVAX going missing from the unlocked marketing funds raised eyebrows in the community. That’s right. No multisig. Someone — the lead dev — at Gondola sold their token into AVAX. An error was declared (the lead developer had apparently misinterpreted the use of the marketing fund for his own pocket), and apologies were made by the rest of the team, including Roger.

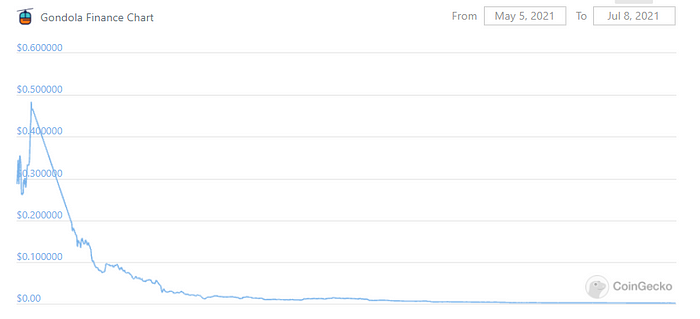

Interestingly, prior to this, the Gondola developers had not been active on telegram for at least 6 weeks in any meaningful way, despite desperate attempts to engage Roger and the developers on tokenomics, nothing was mentioned other than “NDAs” and replies from admins that the developer is “busy”. The token price has been a disaster, leaving may people who bought the token in an extreme negative ROI. Even a PEFI developer has chimed in to make suggestions for the crashing GDL price.

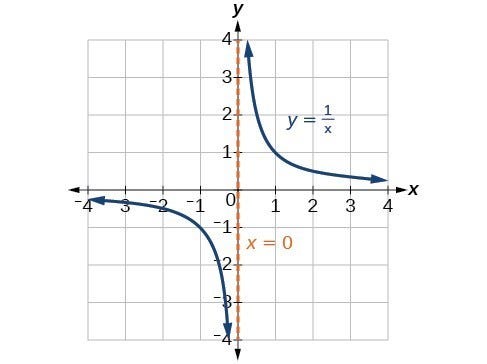

Arguably, the “oversight” of selling GDL from the fund has been dwarfed by the autocompounders and holders of the stable swaps selling their token rewards. The price performance of $GDL since launch has invariably been down at the order of y=1/x. A graph of a chart of y=1/x is below, with a GDL token price chart at the end of the article.

An Ask-Me-Anything AMA has been promised by “community admins” waiting for Roger to make himself available with the lead developer “avalanche skier”.

At best, this is poor situational management by a prominent advisor and negligent tokenomics from the team. At worst, this scheme has filled the pockets of early capital heavy investors, involving selling of a useless token - GDL - into oblivion from holding the valued capital required for enabling the swap function. This exposes Roger and Ava labs to risks of litigation in the future for a lack of due diligence and poor situational management. The Gondola team have thus far failed to engage their community, support the GDL token price, or provide much needed answers. Far from community DeFi with an interactive project team, or TradFi with answerable entities, the setup belongs to a separate category.

Let’s hope after the initial apologies, the developers, and Roger, pull through with a robust plan.

Me? I’m carefully looking at the ILO feature coming to Avalanche, to turn this situation back on itself if needed. If a system can’t govern it’s own self-funded infrastructure, let the community decide if funding traditional litigation against tangible entities is worthwhile recourse, to ensure proper protections and protocols are followed in future applications.

The support and shilling by Roger, an identifiable individual associated with registered and related companies such as Ava labs comes with responsibilities which were not upheld, although an AMA is promised in the very near future. Until an AMA is held sucessfully, this remains the case.

This could be ugly for Avalanche if it’s own ILO system is turned on itself due to behavour in its poorly governed DeFi ecosystem (any Eth maxis out there?)